south dakota excise tax on vehicles

Its free to sign up and bid on jobs. Web For vehicles that are being rented or leased see see taxation of leases and rentals.

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Web Get all the information you will need to title or renew your vehicle registration and license plates for your commercial vehicles.

. A 2 contractors excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement. Web Motor Vehicle Title Printing Delay. Web South dakotas licensing fees help counties pay for road repairs and the state collects a 3 percent excise tax on vehicles purchased and then licensed in south.

Web Though you can save money you know the payments involved to register your car with South Dakota states Motor Vehicle Division. Web Section 32-5B-11 - Effective 712022 Licensing and payment of tax on leased vehicles-Assessment of tax upon purchase by lessee-Lessor to assign title and certify price fees. The motor vehicle excise tax is in addition to motor.

Motor vehicles are not subject to the motor vehicle excise tax if. Web Qualified Utility Projects. Web 32-5B-13 - Licensing and titling of used vehicle by dealer--Payment of tax by subsequent purchaser.

Chapter 10-36 Rural Electric Companies. Web 84-Insurance company titles vehicleboat and does not pay 4 excise tax. Its free to sign up and bid on jobs.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. Web 2 days agoThe department issued a news release on Tuesday announcing the motor fuels and alternative fuels tax for 2023 will increase from the current 385 cents to 405 cents. Web Total consideration does not include title fees registration fees vehicle excise tax paid pursuant to 32-5B-1 32-5B-11 and 32-5B-21 to 32-5B-24 inclusive federal excise.

11-18-2022 1 minute read. South Dakota has more than 12 million registered vehicles but there are only about 900000 people living there. All the documents you need to register fast.

However some state excise tax is deductible as personal property tax on Schedule A itemized deductions in. South Dakota charges a 4 excise sales. Sales and excise taxes are two separate taxes that many people pay attention to.

Web In South Dakota an ATV MUST be titled. Web that is subject to sales tax in South Dakota. Web Heres a quick fact.

Web Vehicles in South Dakota. Uses the product or service in a municipality that. Mobile Manufactured homes are subject to the 4 initial registration fee.

On November 9 th DOR announced that we would be delaying the printing of paper titles. Web Qualified Utility Companies. However if purchased by an out of state business.

911 Emergency Surcharge. Web Search for jobs related to South dakota excise tax on vehicles or hire on the worlds largest freelancing marketplace with 21m jobs. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax.

32-5B-14 - Licensing and payment of excise tax on new vehicle by dealer. Chapter 10-35 Electric Heating Power Water Gas Companies. Web North Dakota allows credit for any excise tax paid on a motor vehicle in another state if that state allows a reciprocal credit.

Web Search for jobs related to South dakota excise tax on vehicles or hire on the worlds largest freelancing marketplace with 22m jobs. Plates are not removed from vehicle08 92-House trailer subject to 4 initial registration fee upon. Web Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax.

Web No excise taxes are not deductible as sales tax. Web The use in this state of motor vehicles exempt from the motor vehicle excise tax pursuant to 32-5B-2 is specifically exempted from the tax imposed by this chapter.

South Dakota Fuel Tax Changes April 2015 Avalara

South Dakota Income Tax Tax Benefits South Dakota Dakotapost

State Motor Fuel Excise Taxes Transportation Investment Advocacy Center

Motor Vehicle South Dakota Department Of Revenue

Cars Trucks Vans South Dakota Department Of Revenue

What Transactions Are Subject To The Sales Tax In North Dakota

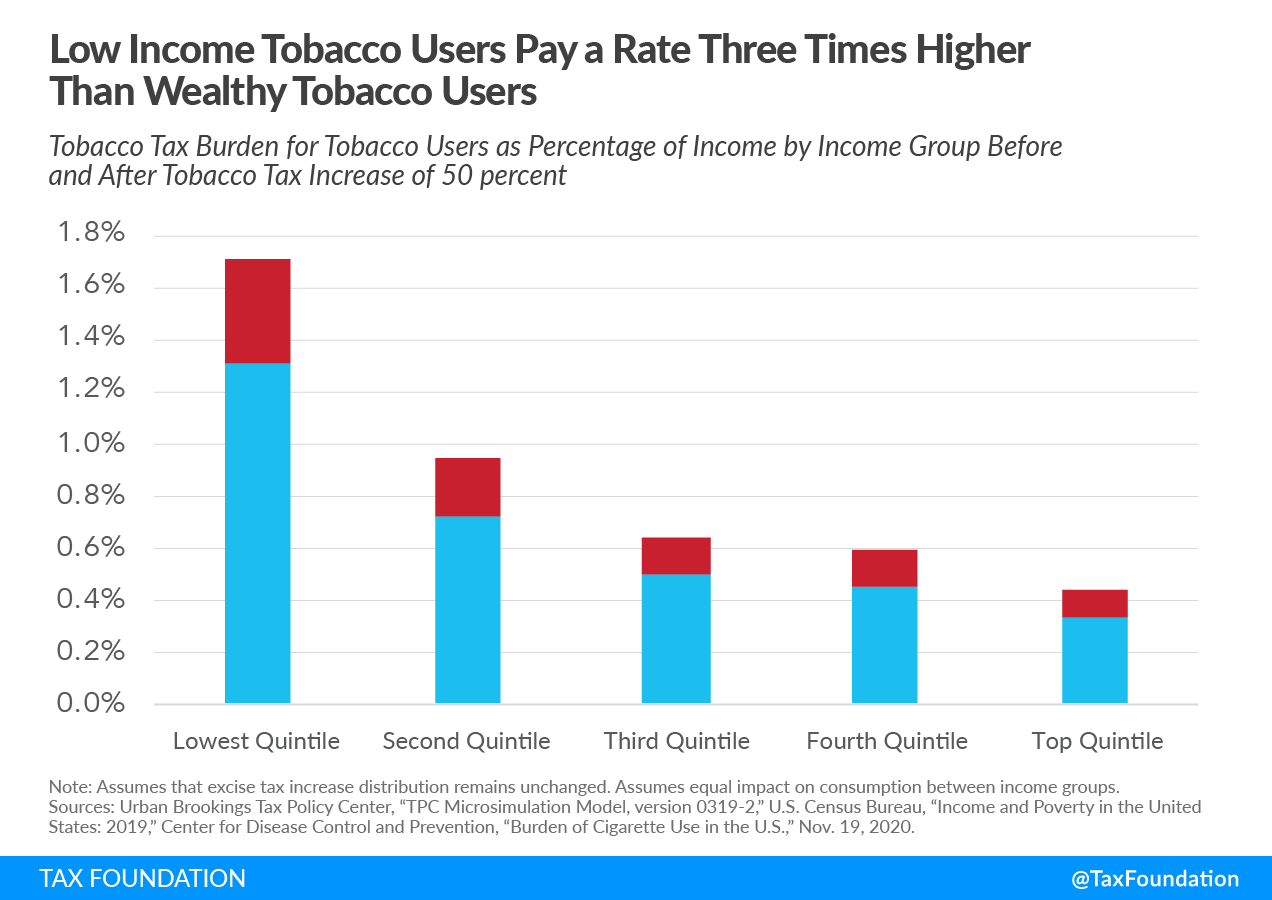

Excise Taxes Excise Tax Trends Tax Foundation

Excise Taxes Excise Tax Trends Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Become A South Dakota Resident In 6 Easy Steps

How To File And Pay Sales Tax In South Dakota Taxvalet

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Excise Taxes Excise Tax Trends Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

What Is The Gas Tax Rate Per Gallon In Your State Itep

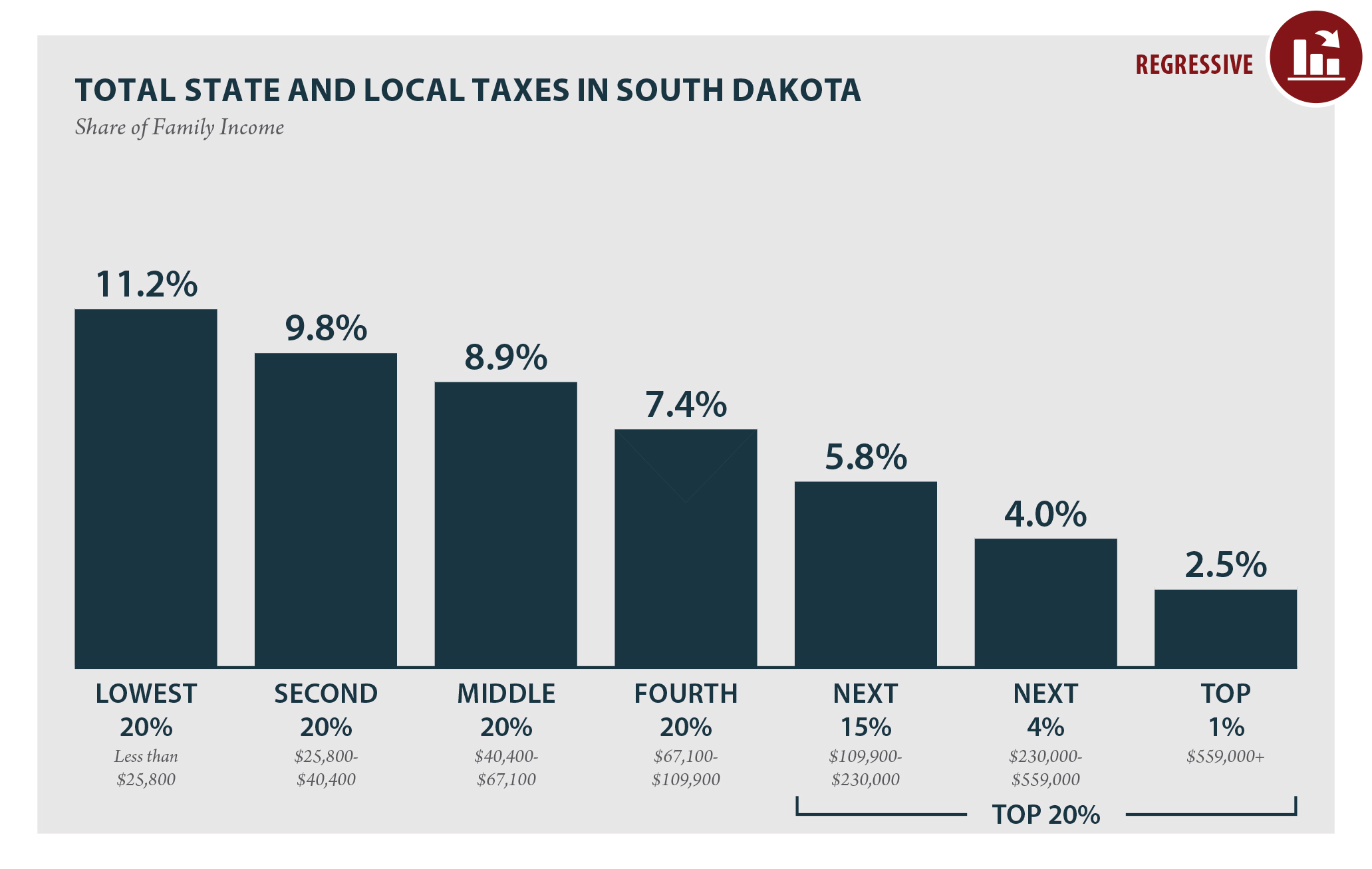

South Dakota Who Pays 6th Edition Itep

South Dakota Taxes Sd State Income Tax Calculator Community Tax